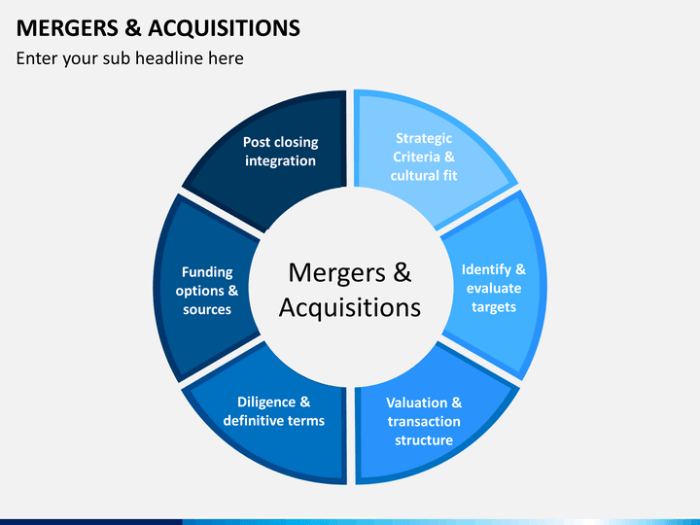

Mergers and acquisitions (M&A) are complex undertakings, requiring meticulous planning, efficient execution, and seamless integration. The sheer volume of data, communication, and due diligence involved can quickly overwhelm even the most experienced teams. This is where M&A CRM software steps in, providing a centralized platform to streamline the entire M&A lifecycle, from initial target identification to post-merger integration.

Understanding the Role of CRM in M&A

Traditional Customer Relationship Management (CRM) systems focus on managing customer interactions. However, in the context of M&A, CRM software takes on a broader role, encompassing the management of relationships with potential acquisition targets, deal teams, investors, and even employees of the acquired company. It becomes a central repository for all deal-related information, enhancing transparency, collaboration, and ultimately, the success rate of M&A transactions.

Key Features of Effective M&A CRM Software

- Deal Management: Tracking the progress of multiple deals simultaneously, managing deadlines, and assigning tasks to team members. This includes features like deal pipelines, customizable workflows, and progress dashboards.

- Contact Management: Maintaining detailed profiles of key stakeholders involved in each deal, including contact information, communication history, and relationship notes. This facilitates targeted communication and relationship building.

- Document Management: Securely storing and sharing all relevant documents, such as NDAs, financial statements, legal agreements, and due diligence reports. Version control and access permissions are crucial features.

- Communication & Collaboration: Facilitating seamless communication and collaboration among internal and external stakeholders through integrated messaging, email, and file-sharing capabilities.

- Reporting & Analytics: Providing real-time insights into deal progress, performance metrics, and key trends. Customizable reports and dashboards help monitor deal health and identify potential risks.

- Integration with other tools: Seamless integration with other business applications such as financial software, legal databases, and project management tools, creating a unified ecosystem for M&A activities.

- Security & Compliance: Ensuring the security and confidentiality of sensitive data through robust access controls, encryption, and compliance with relevant regulations (e.g., GDPR, CCPA).

Benefits of Implementing M&A CRM Software

The advantages of using specialized M&A CRM software extend beyond simple organization. It significantly enhances the efficiency and effectiveness of the entire M&A process, leading to:

Source: vidyard.com

- Improved Deal Flow Management: Streamlining the deal process, reducing bottlenecks, and accelerating deal closure.

- Enhanced Collaboration: Fostering better communication and collaboration among internal and external stakeholders.

- Reduced Risk: Minimizing errors and inconsistencies through centralized data management and standardized workflows.

- Better Decision-Making: Providing real-time insights and data-driven analytics to support informed decision-making.

- Increased Deal Success Rate: Ultimately, leading to a higher success rate in M&A transactions.

- Cost Savings: Reducing operational costs associated with manual processes and information silos.

Choosing the Right M&A CRM Software

Selecting the appropriate M&A CRM software requires careful consideration of several factors:

Source: nmsconsulting.com

- Size and Complexity of Deals: The software should be scalable to handle the volume and complexity of your M&A activities.

- Integration with Existing Systems: Ensure seamless integration with your existing business applications.

- User-Friendliness and Ease of Use: The software should be intuitive and easy to use for all team members.

- Security and Compliance: Prioritize software that meets your security and compliance requirements.

- Vendor Support and Training: Choose a vendor that provides excellent customer support and training.

- Cost and Pricing Model: Evaluate the cost of the software and its pricing model to ensure it aligns with your budget.

Top M&A CRM Software Solutions

(Note: This section would typically list and briefly describe several leading M&A CRM software solutions. Due to the dynamic nature of the software market and potential for bias, specific product names are omitted here. A thorough online search using s like “M&A CRM software,” “deal management software,” and “merger acquisition software” will yield numerous options.)

Source: sketchbubble.com

Post-Merger Integration with CRM

The role of CRM doesn’t end with deal closure. Post-merger integration is a critical phase, and CRM software plays a vital role in facilitating a smooth transition. This includes:

- Integrating customer databases: Consolidating customer data from both organizations into a unified system.

- Harmonizing sales and marketing processes: Aligning sales and marketing strategies and processes to leverage synergies.

- Managing employee transitions: Tracking employee movements, communication, and onboarding processes.

- Monitoring integration progress: Tracking key metrics and progress toward integration goals.

Frequently Asked Questions (FAQ)

- Q: What is the difference between a general CRM and an M&A CRM? A: A general CRM focuses on customer relationship management, while an M&A CRM is specifically designed to manage the complexities of mergers and acquisitions, including deal tracking, due diligence, and post-merger integration.

- Q: How much does M&A CRM software cost? A: The cost varies depending on the vendor, features, and number of users. Pricing models can range from subscription-based to one-time purchases.

- Q: Is M&A CRM software suitable for small businesses? A: While larger enterprises often benefit most, even smaller businesses undertaking M&A activities can leverage the benefits of a CRM system, potentially starting with more affordable or cloud-based solutions.

- Q: How can I choose the right M&A CRM software for my business? A: Consider your specific needs, budget, and the size and complexity of your deals. Research different vendors, compare features, and request demos before making a decision.

- Q: What are the key metrics to track with M&A CRM software? A: Key metrics include deal pipeline velocity, deal closure rate, due diligence completion time, and post-merger integration progress.

Conclusion

M&A CRM software is no longer a luxury but a necessity for organizations looking to successfully navigate the complexities of mergers and acquisitions. By streamlining processes, enhancing collaboration, and providing valuable insights, it significantly increases the likelihood of achieving successful and profitable outcomes. Investing in the right M&A CRM software is an investment in the future success of your organization.

Call to Action

Ready to streamline your M&A process and improve your deal success rate? Contact us today for a free consultation and learn how our expertise and the right M&A CRM software can help you achieve your acquisition goals.

Clarifying Questions

What are the key features of M&A CRM software?

Key features often include contact management, deal tracking, document management, reporting and analytics, communication tools, and integration with other business systems.

How much does M&A CRM software cost?

Pricing varies greatly depending on the vendor, features, and number of users. Expect a range from subscription-based models to more complex, customized solutions with higher upfront costs.

How does M&A CRM software improve due diligence?

It streamlines the process by centralizing all relevant documents and information, improving organization and accessibility for the due diligence team, leading to more efficient reviews.

What types of companies benefit most from M&A CRM software?

Companies that frequently engage in M&A activities, particularly larger organizations with complex deal pipelines, benefit the most from these systems.