Crm software for financial services – The financial services industry is highly competitive, demanding efficiency, personalized service, and stringent regulatory compliance. Customer Relationship Management (CRM) software has become indispensable for firms navigating this complex landscape. This comprehensive guide explores the crucial role of CRM in financial services, examining its features, benefits, and considerations for successful implementation. We’ll delve into various CRM types, integration capabilities, security protocols, and the future trends shaping this vital technology.

Understanding the Needs of Financial Services CRM

Financial institutions, whether banks, investment firms, insurance companies, or wealth management advisors, share common needs that CRM addresses effectively. These include:

- Enhanced Client Onboarding: Streamlining the client acquisition process, gathering necessary information efficiently, and ensuring regulatory compliance.

- Improved Client Retention: Building stronger client relationships through personalized communication, proactive service, and timely follow-ups.

- Regulatory Compliance: Maintaining accurate client records, adhering to KYC/AML regulations, and ensuring data security.

- Increased Sales Productivity: Equipping sales teams with the tools and insights to identify and convert leads effectively.

- Better Risk Management: Identifying and mitigating potential risks associated with clients and transactions.

- Data-Driven Decision Making: Leveraging comprehensive client data to analyze trends, personalize offerings, and improve business strategies.

Types of CRM Software for Financial Services

The market offers various CRM solutions tailored to the specific needs of financial institutions. These include:

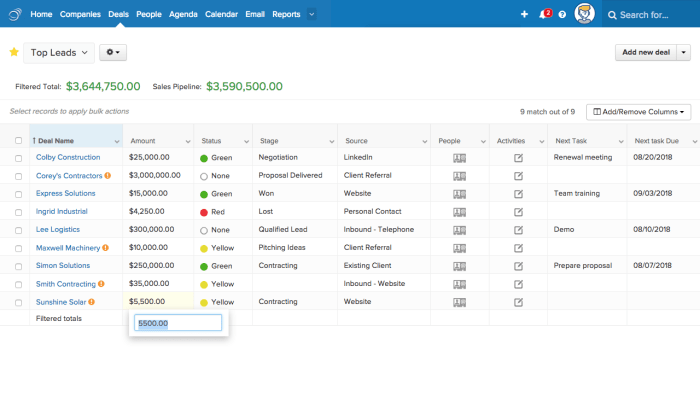

Source: thecfoclub.com

1. On-Premise CRM

This traditional approach involves installing and managing the CRM software on the organization’s own servers. It offers greater control over data security and customization but requires significant IT infrastructure and maintenance.

2. Cloud-Based CRM

Cloud-based CRM solutions are hosted on the vendor’s servers, offering scalability, accessibility, and reduced IT overhead. This is often the preferred choice for its flexibility and cost-effectiveness. Examples include Salesforce Financial Services Cloud, Microsoft Dynamics 365 for Finance, and many others.

3. Hybrid CRM

A hybrid approach combines elements of both on-premise and cloud-based solutions, allowing organizations to leverage the benefits of both models. This is suitable for organizations with sensitive data that requires on-premise storage while benefiting from cloud-based scalability for less sensitive information.

Key Features of a Robust Financial Services CRM

A successful CRM for financial services should incorporate several key features:

- Client 360° View: A centralized repository of all client-related information, providing a comprehensive overview of their interactions and financial standing.

- Workflow Automation: Automating repetitive tasks such as client onboarding, communication, and reporting, freeing up staff for more strategic activities.

- Advanced Analytics and Reporting: Providing insights into client behavior, sales performance, and risk management, enabling data-driven decision making.

- Security and Compliance: Robust security measures to protect sensitive client data and ensure compliance with relevant regulations like GDPR, CCPA, and industry-specific guidelines.

- Integration Capabilities: Seamless integration with other financial systems, such as core banking systems, investment platforms, and accounting software.

- Mobile Accessibility: Accessing client information and performing tasks from anywhere, anytime, through mobile devices.

- Customizable Dashboards: Tailoring dashboards to display relevant information for different user roles, providing a personalized experience.

Benefits of Implementing CRM in Financial Services

The advantages of implementing a CRM system are significant and contribute to improved efficiency, profitability, and client satisfaction:

- Improved Client Relationships: Personalized communication and proactive service enhance client loyalty and satisfaction.

- Increased Sales and Revenue: Streamlined sales processes and targeted marketing campaigns lead to higher conversion rates and revenue growth.

- Reduced Operational Costs: Automation of repetitive tasks and improved efficiency reduce operational costs.

- Enhanced Compliance: Centralized data management and automated workflows ensure compliance with regulatory requirements.

- Better Risk Management: Comprehensive client data and analytics enable proactive identification and mitigation of risks.

- Improved Decision Making: Data-driven insights provide a clearer understanding of client behavior and market trends.

Choosing the Right CRM for Your Financial Institution

Selecting the right CRM involves careful consideration of several factors:

- Business Needs: Define your specific requirements and objectives for implementing a CRM system.

- Budget: Determine your budget and explore different pricing models, such as subscription-based or perpetual licenses.

- Scalability: Choose a solution that can adapt to your organization’s growth and changing needs.

- Integration Capabilities: Ensure seamless integration with existing systems and future technology investments.

- Security and Compliance: Prioritize security features and compliance certifications to protect sensitive data.

- Vendor Support: Evaluate the vendor’s reputation, support services, and training resources.

Future Trends in Financial Services CRM

The financial services CRM landscape is constantly evolving. Key trends include:

- Artificial Intelligence (AI): AI-powered features such as chatbots, predictive analytics, and automated workflows are enhancing efficiency and personalization.

- Open Banking and APIs: Open banking initiatives are fostering greater data sharing and integration, leading to more personalized and innovative services.

- Blockchain Technology: Blockchain’s potential for secure data management and enhanced transparency is being explored in the context of CRM.

- Hyper-Personalization: Leveraging data analytics and AI to deliver highly personalized experiences to individual clients.

Frequently Asked Questions (FAQ)

- Q: What is the cost of CRM software for financial services? A: The cost varies significantly depending on the chosen solution, features, and number of users. Cloud-based solutions typically offer subscription-based pricing, while on-premise solutions involve upfront costs and ongoing maintenance expenses.

- Q: How long does it take to implement a CRM system? A: Implementation time depends on the complexity of the system, the size of the organization, and the level of customization required. It can range from a few weeks to several months.

- Q: What are the key security considerations for CRM in financial services? A: Security is paramount. Choose a solution with robust security features such as encryption, access controls, and regular security audits. Compliance with regulations like GDPR and CCPA is crucial.

- Q: How can I ensure successful CRM implementation? A: Successful implementation requires careful planning, user training, data migration, and ongoing support. Engage stakeholders, define clear objectives, and monitor progress throughout the process.

- Q: What are the benefits of integrating CRM with other financial systems? A: Integration enhances efficiency, data consistency, and reporting accuracy. It provides a holistic view of client interactions and financial data.

References

While specific product links are avoided to maintain neutrality, general resources can be found through searches on reputable sites like Gartner, Forrester, and Capterra for CRM software reviews and comparisons within the financial services sector. Consult industry publications and regulatory bodies for compliance-related information.

Call to Action

Ready to transform your financial institution’s client relationships and operational efficiency? Contact us today for a consultation to explore how the right CRM solution can empower your success.

FAQ Guide

What are the key features to look for in a financial services CRM?

Key features include robust security, compliance features (e.g., GDPR, CCPA), integration with existing systems, reporting and analytics dashboards, and customizable workflows.

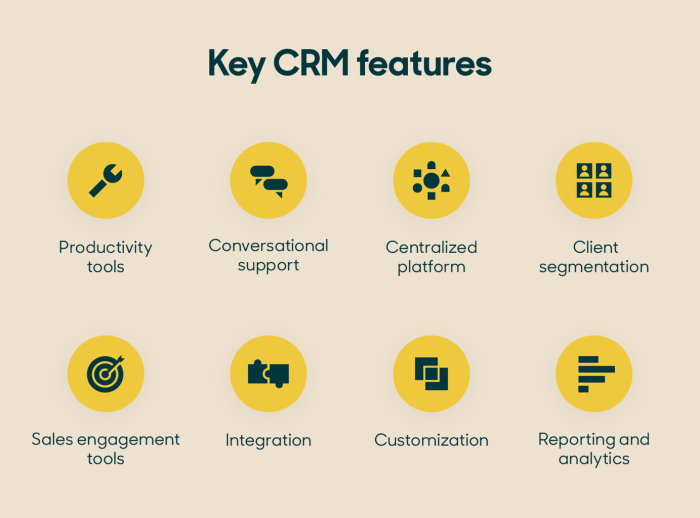

Source: cloudfront.net

How much does CRM software for financial services cost?

Pricing varies widely depending on the size of the institution, the features required, and the vendor. Expect a range from subscription-based models to large upfront investments for enterprise-level solutions.

What is the implementation process like?

Implementation typically involves a needs assessment, system configuration, data migration, user training, and ongoing support. The timeline can range from several weeks to several months, depending on the complexity.

How can I ensure data security within a financial services CRM?

Prioritize vendors with strong security certifications (e.g., SOC 2), robust encryption protocols, and access control features. Regular security audits and employee training are also crucial.