Finding the right Customer Relationship Management (CRM) software is crucial for insurance agencies of all sizes. A robust CRM streamlines operations, improves client relationships, and ultimately boosts profitability. This comprehensive guide explores the best insurance CRM software options available, considering features, pricing, and suitability for various needs. We’ll delve into key functionalities, address common concerns, and help you make an informed decision.

Key Features to Look for in Insurance CRM Software

Choosing the right insurance CRM involves careful consideration of several key features. Not all CRMs are created equal, and the ideal solution will depend on your specific agency’s size, operational style, and client base. Here are some essential features to prioritize:

Client Management & Data Organization

- Centralized Database: A unified database is essential for storing all client information, including contact details, policy information, communication history, and claims data. This ensures easy access and prevents data silos.

- Policy Management: The CRM should seamlessly integrate with your policy administration system, allowing for easy policy tracking, renewal reminders, and efficient management of policy changes.

- Contact Management: Effective contact management tools, including email integration, call logging, and task management, are crucial for maintaining strong client relationships.

- Customizable Fields: The ability to customize fields allows you to tailor the CRM to your specific needs, capturing all relevant client and policy information.

Sales & Lead Management

- Lead Capture & Tracking: Effective lead management features help you identify, qualify, and nurture leads, converting them into paying clients.

- Sales Pipeline Management: Visualizing your sales pipeline allows you to track progress, identify bottlenecks, and improve sales efficiency.

- Reporting & Analytics: Comprehensive reporting and analytics tools provide valuable insights into sales performance, allowing you to identify areas for improvement.

- Integration with Marketing Automation: Integrating your CRM with marketing automation tools enables targeted marketing campaigns and personalized communication.

Claims Management

- Claims Tracking: Efficiently track the status of claims, ensuring timely processing and resolution.

- Document Management: Centralized storage and easy access to claim-related documents simplify the claims process.

- Communication Management: Streamline communication with clients and adjusters throughout the claims process.

Compliance & Security

- Data Security: Choose a CRM with robust security measures to protect sensitive client data, complying with relevant regulations like HIPAA and GDPR.

- Audit Trails: Maintain a complete audit trail of all activities within the system for compliance purposes.

- User Roles & Permissions: Implement granular user roles and permissions to control access to sensitive information.

Integration & Customization

- API Integrations: Look for a CRM with open APIs, allowing for seamless integration with other essential business tools, such as accounting software and email marketing platforms.

- Customization Options: The ability to customize workflows and reporting features allows you to tailor the CRM to your specific needs.

- Mobile Accessibility: Access your CRM from anywhere, anytime, using a mobile app.

Top Insurance CRM Software Options

The market offers a wide range of insurance CRM software. The best choice depends on your specific requirements and budget. Here are some leading contenders:

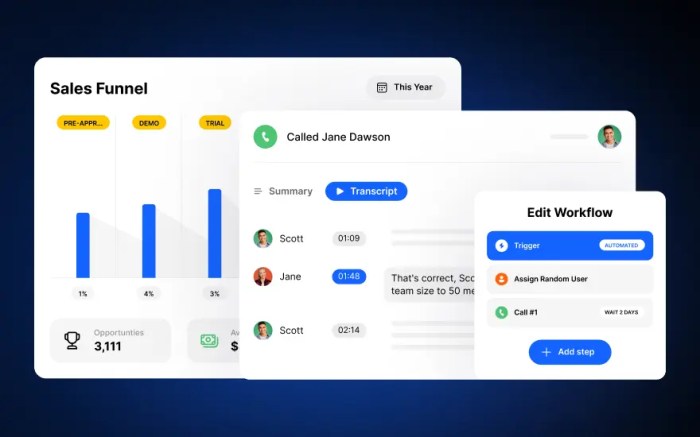

Source: website-files.com

1. Salesforce Sales Cloud

Salesforce is a market leader, offering a powerful and scalable CRM solution. Its extensive features, robust integrations, and customization options make it suitable for large insurance agencies. However, it can be expensive and require significant training.

2. HubSpot CRM

HubSpot offers a user-friendly and cost-effective CRM, particularly beneficial for smaller agencies. Its strong marketing automation capabilities are a significant advantage. While less feature-rich than Salesforce, it provides excellent value for its price.

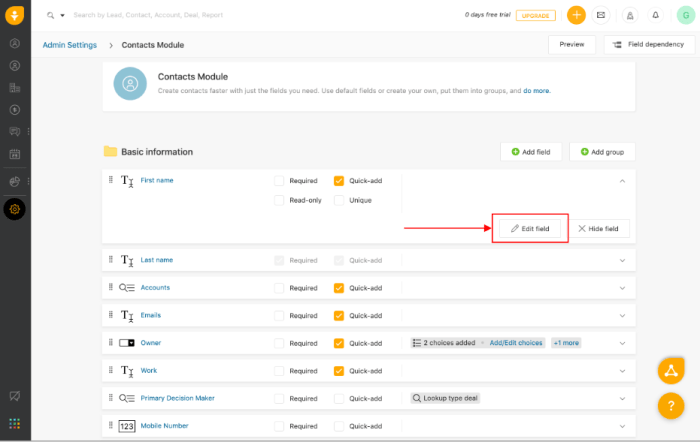

Source: fitsmallbusiness.com

3. Zoho CRM, Best insurance crm software

Zoho CRM provides a comprehensive suite of tools at a competitive price point. Its wide range of integrations and customization options make it a versatile choice for various insurance agency sizes.

4. Microsoft Dynamics 365

Microsoft Dynamics 365 integrates well with other Microsoft products, making it a convenient choice for businesses already using the Microsoft ecosystem. It offers a powerful set of features but can be complex to implement and manage.

5. InsureTech Connect

This CRM is specifically designed for the insurance industry, offering features tailored to the unique needs of insurance agencies. It often boasts strong policy management and claims processing capabilities.

Choosing the Right Insurance CRM: A Step-by-Step Guide

- Assess Your Needs: Identify your agency’s specific requirements, including the number of users, desired features, and budget.

- Research Different Options: Explore various CRM options, considering features, pricing, and reviews.

- Request Demos: Schedule demos with potential vendors to see the software in action.

- Compare Pricing & Features: Create a comparison table to evaluate different options based on features, pricing, and scalability.

- Consider Integrations: Ensure the CRM integrates with your existing systems, such as your policy administration system and accounting software.

- Read Reviews: Check online reviews and testimonials from other insurance agencies to gain insights into user experiences.

- Choose the Best Fit: Select the CRM that best meets your agency’s needs, budget, and long-term goals.

Frequently Asked Questions (FAQ)

- Q: How much does insurance CRM software cost? A: Pricing varies significantly depending on the vendor, features, and number of users. Expect to pay anywhere from a few hundred dollars per month to several thousand dollars per month for enterprise-level solutions.

- Q: Can I integrate my existing systems with a new CRM? A: Most modern CRMs offer API integrations, allowing for seamless integration with other business tools. However, the specific integrations available will vary depending on the CRM vendor.

- Q: How long does it take to implement a new CRM? A: Implementation time varies depending on the complexity of the CRM and the size of your agency. It can range from a few weeks to several months.

- Q: What training is required to use insurance CRM software? A: Most vendors offer training resources, including online tutorials, webinars, and dedicated support staff. The level of training required will depend on the complexity of the software and your team’s technical skills.

- Q: What are the benefits of using insurance CRM software? A: Benefits include improved client relationships, streamlined operations, increased sales efficiency, better compliance, and enhanced data security.

Conclusion

Investing in the right insurance CRM software is a strategic decision that can significantly impact your agency’s success. By carefully considering your needs, researching available options, and following the steps Artikeld above, you can find a solution that enhances your operations, improves client relationships, and drives growth.

Call to Action: Best Insurance Crm Software

Ready to transform your insurance agency with a powerful CRM? Contact us today for a free consultation and let us help you find the perfect solution for your needs!

Expert Answers

What are the key features to look for in insurance CRM software?

Key features include lead management, policy tracking, communication tools (email, phone, SMS), reporting and analytics dashboards, and integration with other business systems.

How much does insurance CRM software typically cost?

Pricing varies widely depending on the features, number of users, and vendor. Expect a range from affordable monthly subscriptions to more expensive enterprise-level solutions.

What is the typical implementation timeline for an insurance CRM?

Implementation time depends on the complexity of the software and the agency’s size, but generally ranges from a few weeks to several months.

Can insurance CRM software integrate with my existing systems?

Source: fitsmallbusiness.com

Many CRMs offer integrations with common business tools like email platforms, accounting software, and phone systems. Check for API compatibility before selecting a solution.